Owning a home otherwise a bit of belongings is a significant dream for many Filipinos. I am aware its for me personally. You will find constantly desired to keeps a location to name personal, where I will raise a family group and construct recollections that will last a life.

Probably one of the most popular measures is actually financial money. This article will take you step-by-action from the means of getting home financing out of an effective financial throughout the Philippines.

1. Determine Your finances

The first step to purchasing a house should be to influence their budget. This will help you restrict your hunt and get away from overspending.

Extremely banking companies regarding the Philippines have a tendency to loans around 80% of one’s property’s appraised worth. Thus you will need to build within the very least 20% of the purchase price as the a downpayment.

In addition to the deposit, additionally, you will need reason behind the new month-to-month amortizations. The fresh amortizations may be the monthly payments you are going to build into the financial to settle the mortgage. We recommend that their month-to-month amortizations shouldn’t surpass 31-40% of the monthly earnings.

dos. Initiate Your residence Google search Travel

Once you have computed your financial budget, it is time to start your home-search travels. There are several different methods to begin it:

- Manage a representative. A realtor helps you select properties one to meet your circumstances and you may finances. Capable and negotiate in your stead and you will guide you because of the purchasing techniques.

- Seek out postings on line. Multiple other sites number qualities found in the latest Philippines. This is exactly a terrific way to rating an overview of the new industry and determine what is available.

- See creator systems. While you are interested in to acquire a good pre-build property, you can visit designer methods. This is an excellent way to comprehend the floors plans and you can facilities prior to these include depending.

3. Put aside a property

After you’ve located the ideal assets, it is the right time to set-aside they. This can ensure that the home is perhaps not ended up selling so you’re able to https://paydayloancolorado.net/twin-lakes/ anybody else before you can enjoys the opportunity to buy it.

The scheduling processes generally speaking pertains to paying a reservation payment. The amount of the brand new scheduling percentage vary with respect to the designer otherwise supplier. not, it is normally around dos% of cost.

After you’ve paid back brand new reservation percentage, you will be given a booking arrangement. It arrangement will story the brand new terms of this new booking, for instance the length of new booking period therefore the matter of one’s put.

This new booking period is generally a month. During this time period, you will find the opportunity to make research towards assets to get resource. If you purchase the assets, the latest reservation payment might be paid into the brand new advance payment.

4. Collect the required Data files to have home financing

The data you’ll need for a mortgage about Philippines can differ of bank so you’re able to bank. not, very financial institutions will require the next:

- Appropriate government-approved IDs for everybody individuals, such as a beneficial passport, license, otherwise Federal ID cards.

- Evidence of money, like payslips, income tax production, or providers monetary statements.

- Certification away from a career (if the applicable).

- Team data (having self-functioning or advertisers).

- Marriage bargain (in the event that relevant).

- Taxation Identity Number (TIN) and you may TIN ID.

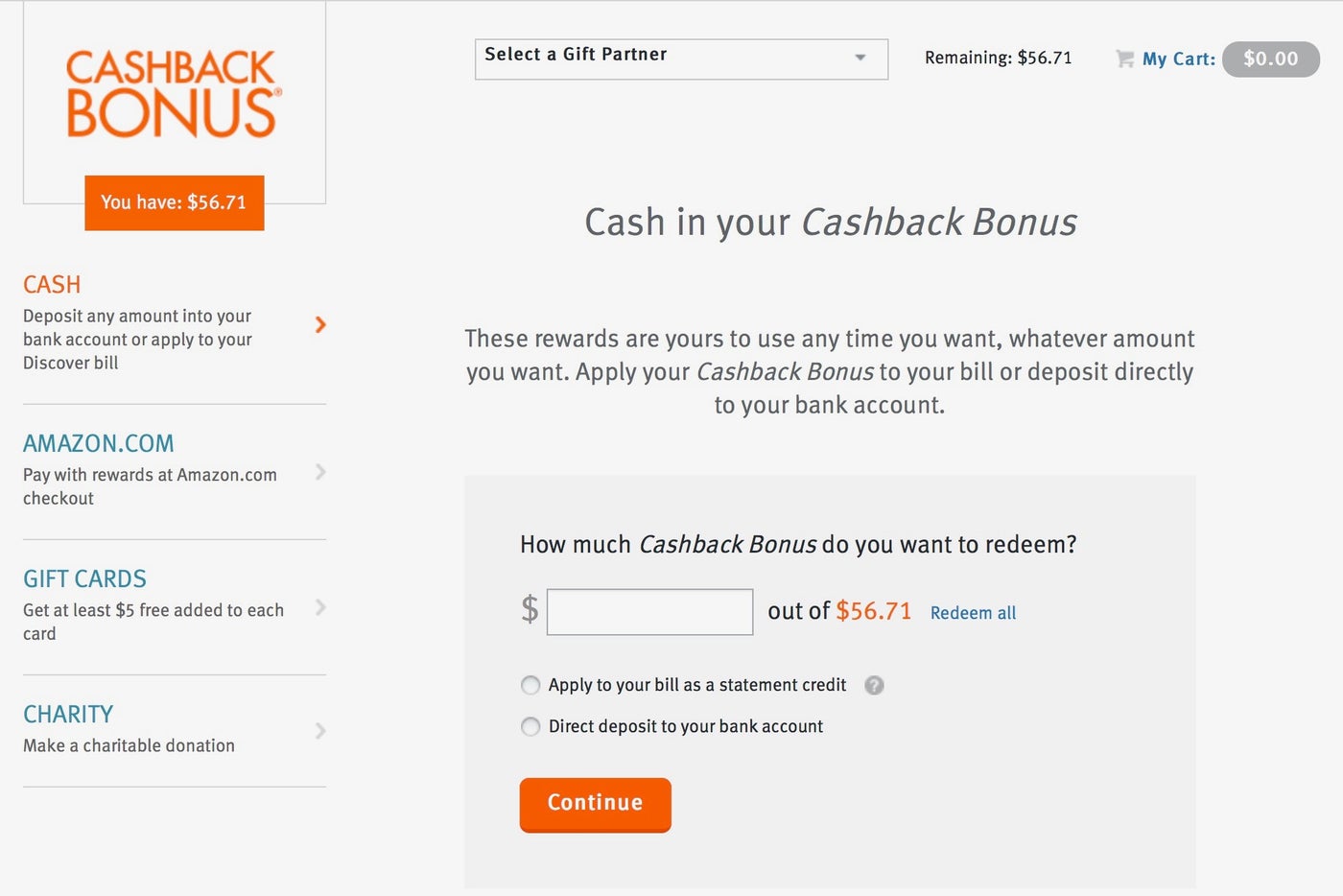

- Evidence of recharging, eg a utility expenses otherwise mastercard report.

It is vital to assemble all these data right that one may, since the bank might require these to process your loan software. You may also query the financial institution having a summary of the fresh new particular documents they require.